Fintech maturity

As for many terms used these days, there are a lot of definitions available, allowing the users to use the best fit for their needs, and FinTech is not an exception. Nevertheless, I found this as potentially neutral, general enough, one size fits all, no biases included, usable option; “We define FinTech as organizations that combine innovative business models and technology to enable, enhance and disrupt financial services”, emphasizing that fintech is not only about early-stage start-ups and new entrants, but also scale-ups, maturing firms and even non-financial services firms.[1] Let’s highlight this part only, FinTech combines innovative business and technology to enhance financial services. We’ll draw an interesting parallel regarding this point a bit late, in the meantime first let’s take a look at the current FinTech maturity round the globe.

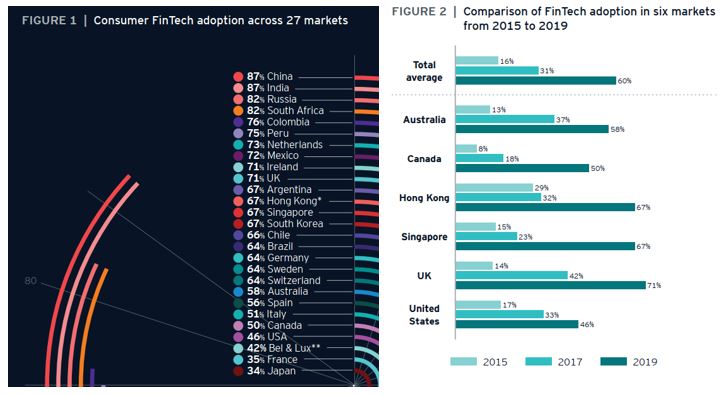

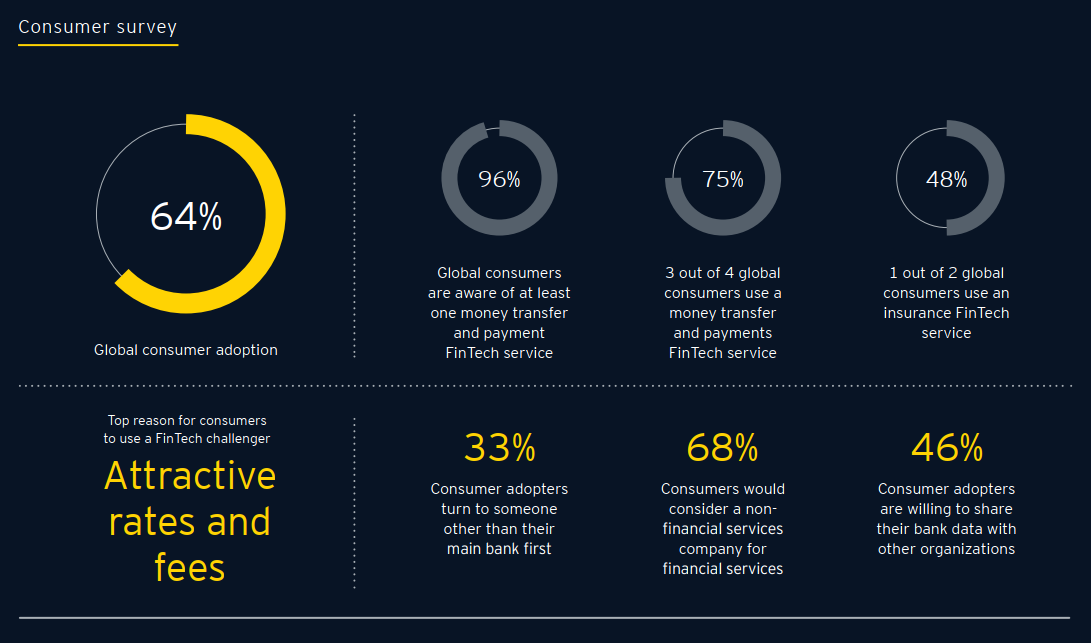

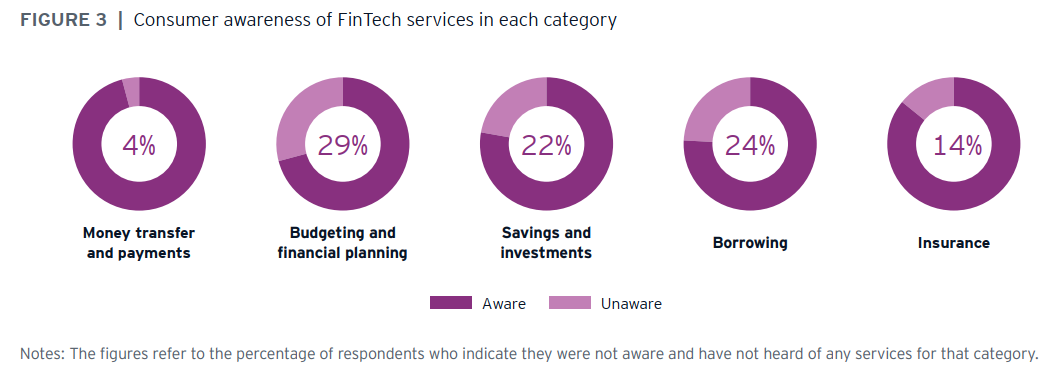

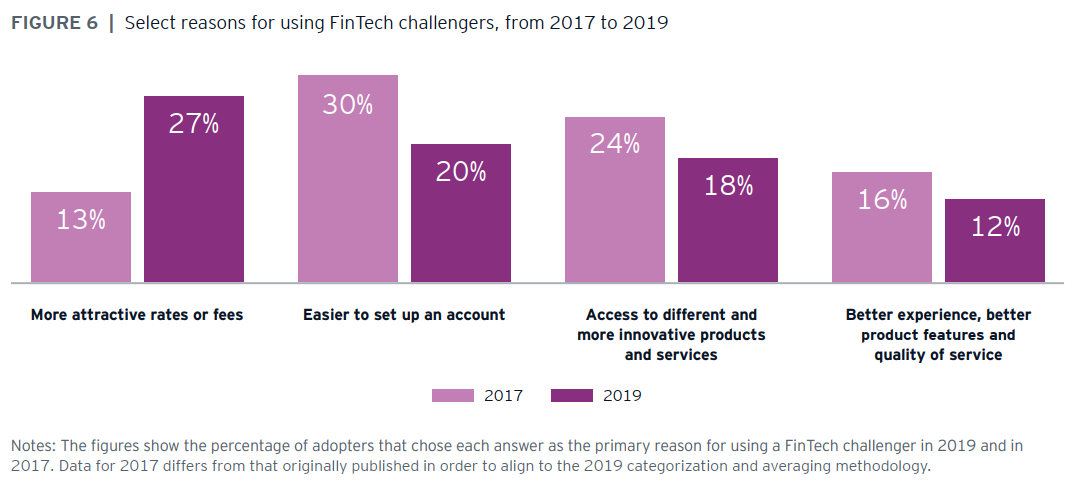

While evaluating different researches we found Global FinTech Adoption Index 2019. made by Ernst & Young[2] truly a very pragmatic summary. You can see there is the highest adoption rate in markets like China and India, and always the present UK, with awareness mostly related to Money transfer and payments as and top reasoning for using FinTech challengers More attractive rates and fees. So, Asian markets are obviously in uprising period among other due to ongoing Super Apps (like WeChat, Alipay) influences[3], clients are driven by not only their better experience but also savings on money transfer which indirectly shows there is still competitive space left for the traditional financial institutions to retain trust of their clients offering expertise in areas beyond simple money transfer.

I’ve talked about this topic recently on the Future of Fintech 2019, a conference where I did a short unplanned survey of the participants attending and the majority agreed that the Croatian market cannot be called itself a FinTech mature market, but a market well aware of the upcoming challenges and trends, with a low re-action rate. This is at least to say, a bit disturbing, since according to Facebook’s report of Millennials + Money[4]: The Unfiltered Journey; 92% of millennials, the largest single generation ever with an average age of 26.5, don’t trust traditional banks.

So, if all of them don’t emigrate by then, in 5-10 years we’ll have highly paid individuals, with no empathy or need for our current present financial institutions/offerings – unless these organizations start changing rapidly to mitigate this risk. Well, did they start?

The “Burden” of Change

We are not talking here about reaching the latest trends of becoming a digital bank Brett King is talking about, even though we should be! – since the biggest mistake in trying to modernize your environments is to go through all “industry revolution” phases instead of ensuring prerequisite to position yourself in the latest stage. We are talking here about ensuring the minimal prerequisites and setup to ensure FinTech sustainability of an organization – from a potential provider as well as a user point of view.

Because drives for change can be different, from outside as well as inside; from the need to be faster in building new service, boosting employer branding, removing legacy technology, exposing core capabilities and differentiation values, to implementing a culture of experimentation.

A Few (easy to use) Tips

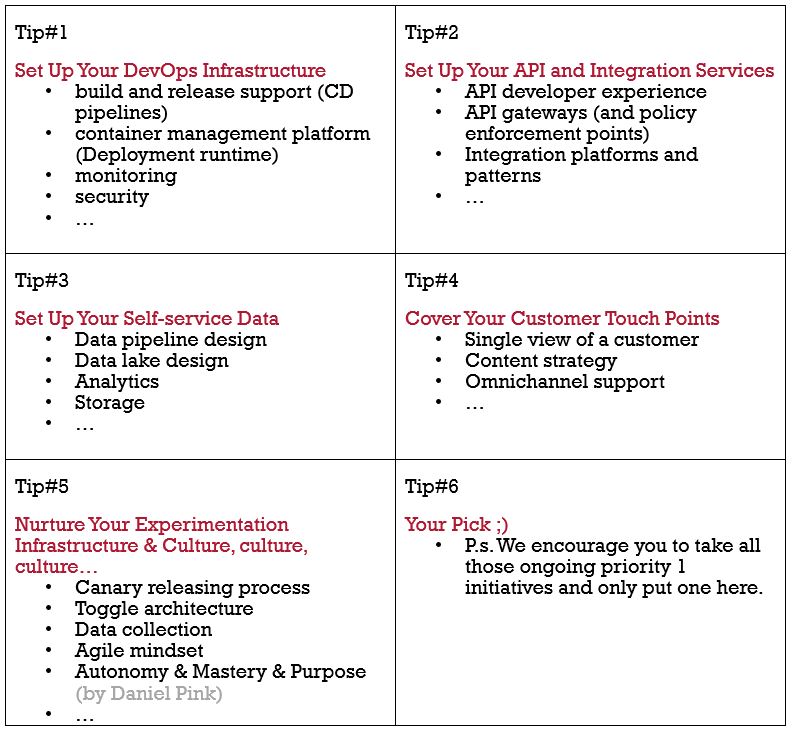

Inspired by ThoughtWorks, who we truly love, our team listed few tips what to look into from an elementary, very concrete, build solid grounds, Business & IT related, pretty much doable, common-sense perspective. Here it goes, embrace yourself.

Digital Platform

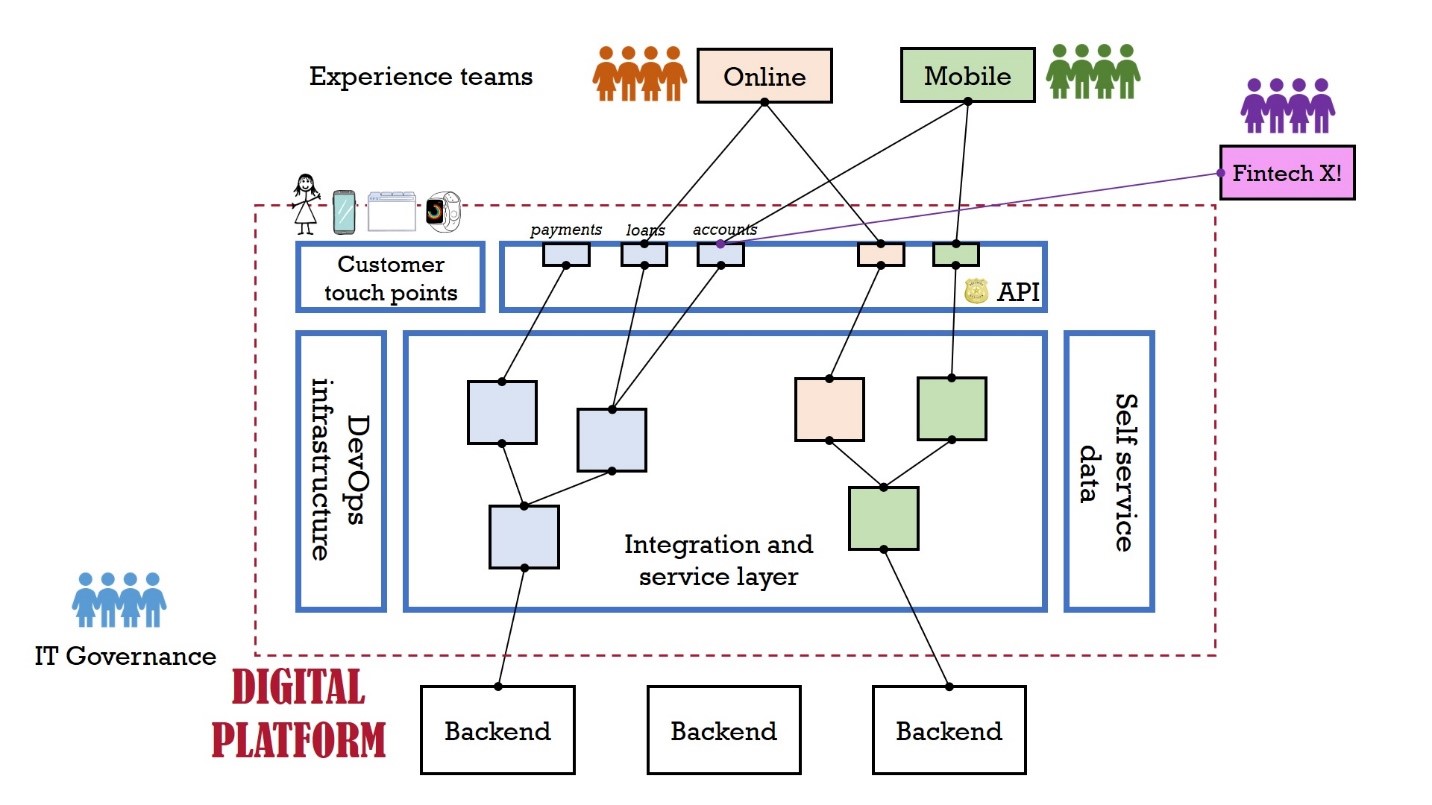

Each of the boxes is a separate complex story for itself and you could have read about some of them on our website already, but for the ones you need more elaboration – reach out. The important thing to highlight here is that all of them live under a unique manageable & governance concept: Digital Platform, where you treat this platform as a product, with internal ‘customers’ of its own. The platform team should be running as a cross-functional product team, it should ultimately be judged on its ability to “boost” or improve the capabilities of the business, it should be challenging the infrastructure laying beneath and platform product owners need to ensure their teams are both focused on the specific tasks at hand and maintaining organizational alignment. So if you connect all the dots it looks like this from the big picture point of view.

C – Level Perspective Alignment

Important to note, if you maybe already took this wrong mind path – a digital platform is NOT a technology initiative, every decision should have a business validation. It’s also NOT put in place by someone from the management, it’s built incrementally together by a nominated team by identifying specific capabilities of existing systems, mapping them to business priorities, targeting specific areas for upgrades and enhancements and repeating the whole process iteratively.

To make this an organization’s success story all C-level perspectives need to be aligned.Probably, goals won’t be, because of the annoying influence of ever present business as usual parameter and after all the difference of each business line’s targets and dynamics, but perspectives should, and that’s a compromise doable for the leaders. And this unique perspective should be a good starting point for building this type of digital platform concept.

To mitigate the described risk of becoming obsolete organizations should start embracing changes fast. Lucky for them, it’s most likely it’s not the infrastructure that is causing them to keep a low profile in this disruptive time but the culture and a long term (or even short term) positioning related to FinTech challenges. If you remember the part we highlighted in the beginning, FinTech combines innovative business and technology to enhance financial services, there is no reason why current financial institutions could not be FinTech themselves.

Wait, come to think of it, it should be part of their core business already.

[1] https://medium.com/the-centre-for-finance-technology-and-entrepreneur/what-is-fintech-what-are-some-definitions-of-fintech-ddffebd98c1d

[2] https://fintechauscensus.ey.com/2019/Documents/ey-global-fintech-adoption-index-2019.pdf

[3] https://www.forbes.com/sites/betsyatkins/2019/09/03/are-super-apps-the-future/#253105f46fd5

[4] https://etcsummit.com/wp-content/uploads/2018/09/Tom-Lee-Fundstrat-How-Millennials-are-Powering-Wall-Street%E2%80%99s-Interest-in-Crypto.pdf

Falls Sie Fragen haben, sind wir nur einen Klick entfernt.