Nexi’s position in Finance

Being a part of Nexi Group, NEXI Croatia is one of Europe’s leading PayTech companies, providing fast and safe payment solutions to people, businesses, and financial institutions in over 25 countries. It also holds the number 1 spot regarding the number of payment cards managed and total transaction value processed. With almost 3 billion active credit cards in the world, the number of fraudulent transactions is consistently growing.

Modernizing Fraud Detection

CROZ was tasked with revolutionizing NEXI Croatia’s fraud detection capabilities through machine learning integration and process automation. The existing system faced four key challenges:

- Overwhelming data volumes

- Outdated technical infrastructure

- Declining accuracy of detection models

- Absence of real-time ML capabilities

The large amounts of data caused the processing time for calculating the feature set to be measured in days while also limiting the expressivity of the features themselves – particularly the amount of history each feature’s calculation is based on. Another reason for the lengthy processing time was an unsuitable development and data science environment. Specifically, the environment was underpowered and underutilized, which meant that the feature calculation process wasn’t as efficient as it could have been.

Nexi’s environment utilized outdated models and tools that struggled to identify sophisticated fraud patterns, with limited scalability options. The existing model relied on a restricted dataset and minimal features due to various constraints, leading to rapid feature drift and deteriorating performance. Without automated ML-Ops processes, model maintenance and updates were cumbersome and time-consuming.

Furthermore, the system’s reliance on short-term historical data meant it couldn’t effectively analyze extended patterns in user and merchant behaviors. While the existing setup offered near real-time detection capabilities, its architecture could not support the advanced models and comprehensive feature sets required for modernized fraud detection systems.

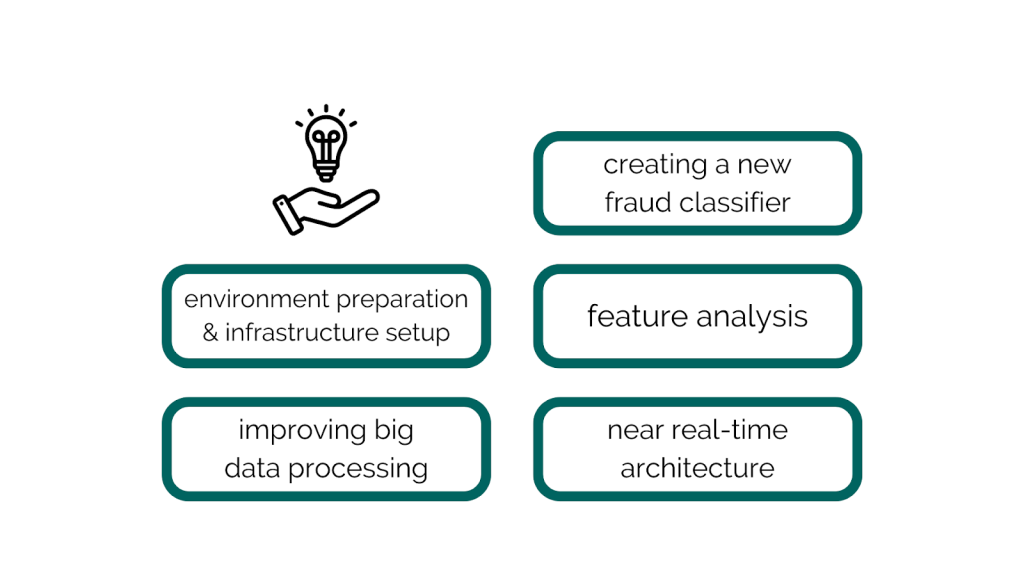

CROZ’s approach targeted all four challenge areas simultaneously. We helped NEXI Croatia deliver improvements across multiple fronts:

- Environment preparation and infrastructure setup: Installing all tools and utilities required to develop the solution, process large datasets, calculate long-term aggregations and train first models

- Improving big data processing: Preparing the final feature dataset by processing large raw transaction. Incorporating complex features into the feature dataset, such as various short- and long-term aggregations, with resolutions ranging between 5 minutes and 9 months. Splitting the feature dataset into a train and test set and implementing various techniques to mitigate class imbalance

- Creating a new fraud classifier: Experimenting with SotA models and tuning their hyperparameters. Training the fraud classifiers on the prepared train sets. Evaluating models using both standard classification metrics (recall, precision, F1 score, AUC-PR…) and business-oriented metrics in comparison with the currently used model (number and value of detected frauds, missed frauds, and false positives)

- Feature analysis: Analyzing all calculated features and their importance, ranking them and determining their overall relevance. Categorizing features into business-level semantic categories and ranking the categories of features.

- Near real-time architecture: Designing and planning the proposed architecture which would be used to calculate features for transactions and classify them in near real-time.

Adapting to future needs with OpenShift AI

In Phase 2 of the project, we have strategically integrated OpenShift and OpenShift AI into the client’s architecture to enable them to harness the power of advanced technologies.

This implementation empowers their data scientists by providing self-service capabilities to provision their own workbenches, allowing them to experiment with various models and parameters seamlessly. With this infrastructure, they can efficiently prepare pipelines for repetitive tasks, such as automatic model retraining and logging in the model registry, ensuring consistent performance and scalability.

Incorporating OpenShift into the fraud system architecture has prepared the client to further modernize and transition to a microservices-based architecture. This shift enables them to use a scalable, fault-tolerant infrastructure that can efficiently handle the complexities of modern applications. Moreover, by adopting GitOps principles, we have automated most operational tasks, significantly reducing manual intervention and enhancing the reliability of deployments.

Additionally, we have introduced nightly long-term feature recalculation to maintain the accuracy and relevance of the models over time. To further enhance the solution, we’ve adopted modern streaming and AI technologies, leveraging Kafka and Flink to create a robust, scalable, and real-time data processing framework. This approach not only supports the client’s immediate needs but also positions them to adapt to future innovations in the AI and data landscape. By incorporating these technologies, we’ve built a solution that is not only powerful and flexible, but also future-proof, aligning with the client’s strategic vision for digital transformation.